This article discusses the principal residence exemption, which can eliminate or reduce a capital gain on the disposition of the principial residence.

You can download the CRA tax guide below.

https://solidtax.ca/wp-content/uploads/2022/09/Income-Tax-Folio-S1-F3-C2-Principal-Residence.pdf

A principal residence is the primary location that a person lives. It is also referred to as a primary residence or main residence.

I sold my own house last year; do I have to pay capital gains on it?

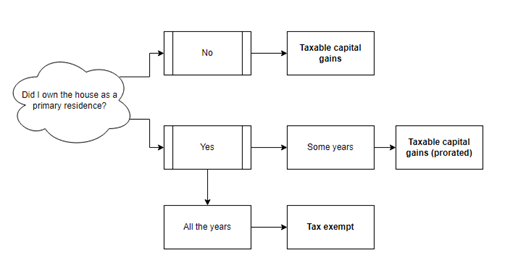

Capital gains on selling a house depends on a few factors and you must ask yourself a few questions to determine whether you will have to pay taxes on capital gains. The following charts shows the general result of selling your house:

I currently live in my house; however, I plan on renting it out one room to a friend; how much do I charge them and how what are the tax implications?

In a situation where you are renting out your home to a friend or relative, CRA requires you to charge rent at fair market value, and if you do not charge rent at fair market value then you must be reporting your rental income at fair market value, and you must pay taxes from the rental income at fair market value.

What are the tax implications when I inherited or received a property as a gift?

The tax implications when receiving a property as a gift can be broken down into two parts. The first part is the disposition of the property from the giver. Typically, the person who is giving or donating the property must pay the appropriate capital gains and recapture of CCA, if it applies. The second part is the person who is receiving the property, they will not be require to pay any capital gains on at the time of the purchase, appropriate capital gains and recapture of CCA, if applicable, must be realized upon the sale of the home.

Can I claim my mortgage payments on my taxes?

Typically you cannot claim your mortgage payments on your income taxes.

Can I rent out my principal residence to a family member for cheap?

This situation is similar to FAQ #6. You must pay taxes on the fair market value of the rental income if you are charging rent below fair market value to a friend.

I have a house that I rent out, but I want to move back into the house to live in; what are the tax implications to this?

We would treat this situation very similar to FAQ #3. It would be considered a deemed disposition if the property is initially used for principal residence, then rented out, and moved back in as primary residence again. The capital gain is deferrable until you actually sell the property. On top of the capital gains, you must be pay taxes on the recapture of CCA if have claimed CCA deduction when your property was rented out.