How taxes work?

Yes, you have to pay taxes on the income you make; however, you are not required to pay taxes on all money you receive. You do not have to pay taxes on, for example, money received as a gift, estate, and loan. Checkout how taxes work from here.

Income that is taxable:

- Investment income – property rental and stock/fund investment income

- Pension income – retirement income, CPP, OAS, etc.

How Taxes Work – Just Like Cutting Cake

Understanding Tax Brackets with Two Concepts:

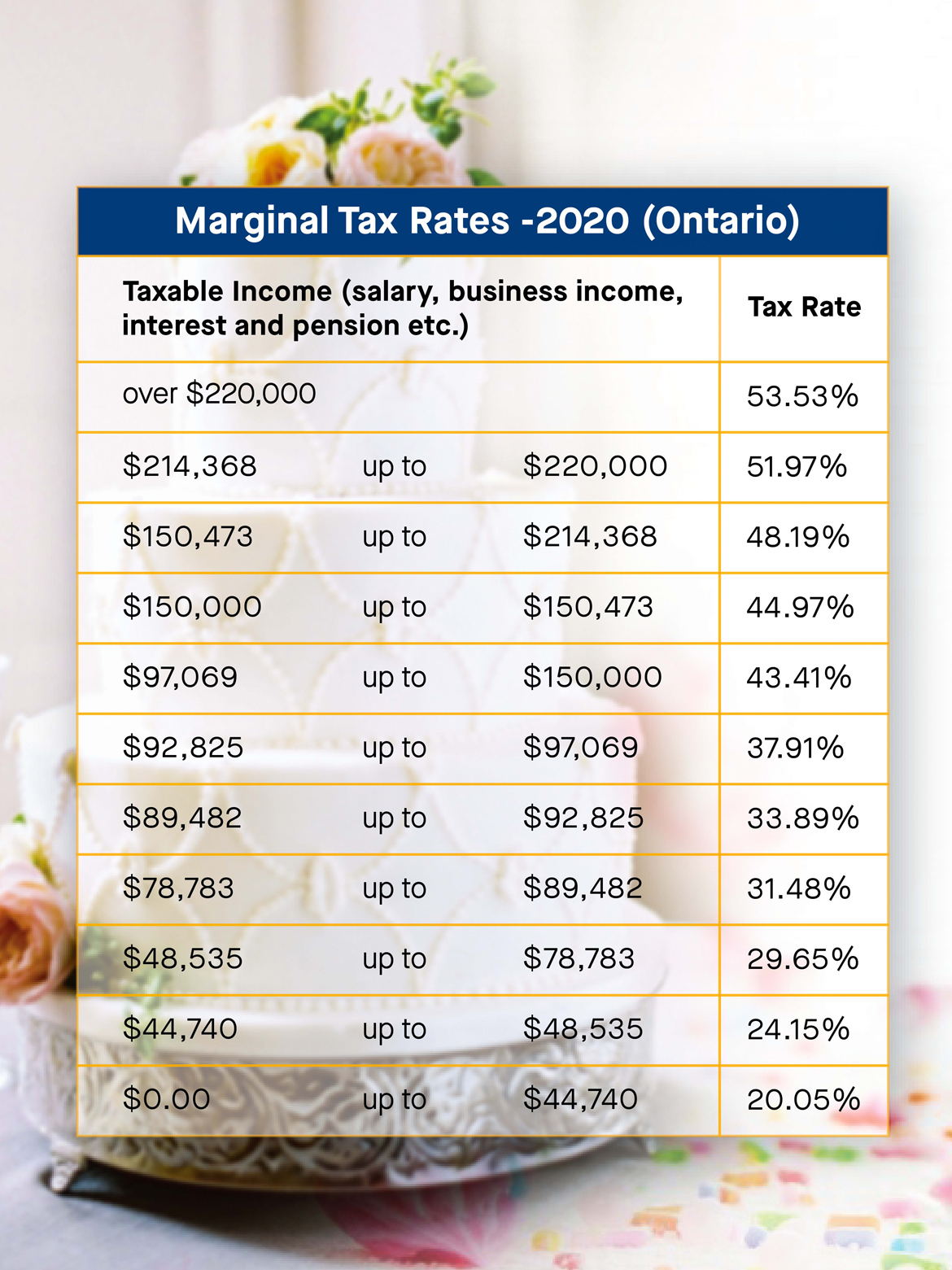

- 1. Your income is separated into different levels called tax brackets, just like a large, layered birthday cake!

- 2. Each level has a different tax rate called marginal tax rates; the higher the level, the higher the tax rate is.

Example

If your taxable income is $100k, you will be taxed on 7 levels with different tax rates. The first level is from $0 to $44,740, where you pay 20.05% tax on the $44,740. The second level is from $44,740 to $48,535, where the tax rate is 24.15%. The highest level is from $97,069 to $100k; the tax rate for this bracket is 43.41%.

If you have $1,000 extra taxable income—that is, if your taxable income increases from $100k to $101k—you have to pay extra tax at $1,000 x 43.41% = $434.1.

If your taxable income is reduced by $1,000 (by contribution $1,000 into RRSP, for example), your tax saving will be $1,000 x 43.41% = $434.1.

How Taxes Work in Canada?

If you contribute $10,000 to RRSP to make your taxable income $90,000, your top marginal tax is 37.91%, and your tax saving will be

(100,000 – 97,069) x43.41% + (97,068-90,000) x37.91%

=2,931×43.41% + 7,068 x 37.91%

= 1272.35 + 2679.48

= 3951.83

In other words, the tax saving rate for the RRSP contribution of 2,931 is 43.41%; for the contribution of $7,068, the tax saving rate is 37.91%.

Conclusion: the higher the income, the higher the marginal tax rate, and the more tax saving you’ll get by contributing to RRSP.

When you are ready to file your tax return or need to talk with us, you can book an appointment using the link below.

solidtax.ca/booking/

Or email us with your inquiries to: info@solidtax.ca